A ‘Happy New Year’ news story from Peter Schiff…one of the earliest predictors of the ‘pop’ of the housing bubble.

December 30, 2010 10:50 AM EST

According to Peter Schiff, the recent drop in home prices is unnerving, but there is still another 20% drop to go before we reach a historical trend line. (emphasis mine)

Schiff notes that some economists anticipate a further correction, but most don't believe that the vicious correction of 2007 and 2008 could return. To counter, Schiff notes that many underestimate how distorted the market had become.

From the start of 1998 through the middle of 2006, arguably at the peak of the market, the Case-Shiller 10-City Index rose an astounding 173% at 19.2% per year. Schiff notes that we now know that the gains had little to do with fundamentals and more to do with "distortionary government policies that mandated loans to marginal borrowers, and set off a national mania for real-estate wealth and a torrent of temporarily easy credit."

One of the co-founders of the Case-Shiller index, Robert Shiller, contends that home prices, from 1900 - 2000, followed a more muted 3.35% average growth rate, which included the Great Depression, post-war eras, and the boom of the 90's.

So, Schiff notes that in 1998, the Case-Shiller index was at 82.7. Following the 3.35% average annual price increase predicted by Shiller lands us at a point of 126.7 in October 2010. However, the Case-Shiller Index came in at 159.0, suggesting an additional 20.3% decline in the index to get it back to more normalized levels.

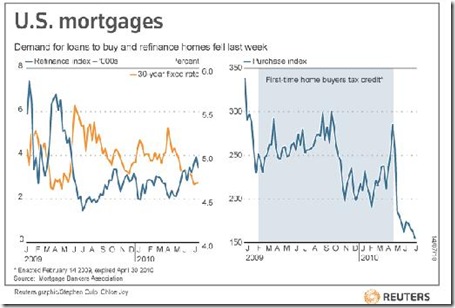

Schiff continues that no one is making a case that fundamentals have gained traction, and most point to government intervention as an artificial stop to the free fall. Programs like "the home buyer's tax credit, record low mortgage rates, government mortgage-assistance programs, and the increased presence of Fannie Mae, Freddie Mac and the Federal Housing Administration in the mortgage-buying business" have put the kibosh on falling prices for now.

But, contends Schiff, with "bloated inventories, 9.8% unemployment (and much higher REAL unemployment), a dysfunctional mortgage industry and shattered illusions of real-estate riches, does it makes sense that prices should simply fall back to the trend line?" He argues that they will overshoot to the downside.

So what's the outcome? A major market correction in the next year.

Schiff thinks not, rather that there may be potential for an additional 10% dip below the 100-year trendline in the next five years, especially if mortgage rates continue upwards to more historical rates of 6% or more. He notes that that would put the index at 114.02, or about 28.3% below where were at now. Even a 5% dip would put the index at 120.36, about 24.3% below current levels.

Concluding, Schiff comments that, "In trying to maintain artificial prices, government policies are keeping new buyers from entering the market, exposing taxpayers to untold trillions in liabilities and delaying a real recovery. We should recognize this reality and not pin our hopes on a return to price normalcy that never was that normal to begin with."