12/24/12

12/16/12

Z.I.R.P. and mortgage rates

Below is an excerpt from a recent article by Barry Habib of MBS Highway

Quite possibly you have heard of the Federal Reserves ZIRP or Zero Interest Rate Policy…below is a good explanation of how it works and the tangential effect on mortgage rates.

Imagine that you are a Money Manager, managing a $100 Million Dollar portfolio. You can borrow at very low rates that are close to the Fed Funds Rate. Call it a 0 .5% cost to borrow. You can buy mortgage bonds that pay 3% . It looks like a nice profit spread of 2 .5% . But the real magic happens when you use leverage. You can buy those bonds with only 10% cash . So you can take your $100 Million and buy $1 Billion worth of bonds, by borrowing the other $900 Million at a cost of only 0 .5% . The 2 .5% profit on the $1Billion is equal to a whopping 25% on your $100 Million dollar portfolio...making you a great money manager, and a heck of a lot of fees. This is called "The Carry Trade". But one sure way to lose money on this trade is to have your borrowing cost rise. So, as the data begins to approach the Fed's targets, managers will be less willing to buy mortgage bonds and begin to unwind their holdings. This selling of mortgage bonds will cause mortgage rates to rise, and perhaps at a surprising pace. We will need to be on guard about this in the months ahead.

The above is important to buyers and sellers alike…for buyers, it is quite obvious how interest rates have an effect on the purchase of a home. an increase in rates from 4% to 5% has the following effect on a $250,000 loan.

Principal and interest payment of $250,000 at 4% is $1,194/mon

Principal and interest payment on $250,000 at 5% is $1,342/mon…that is a 12% increase in payment and can have a significant effect on the size of the loan you can qualify for.

If the rates go to 6% you would be at almost $1,500/mon

So, if you are a buyer, you have try to predict the future of interest rates and home prices (we’re here to help you with that!). Should you buy now at the lowest rates in history, or gamble that home prices will fall if interest rates rise? Can you chart out the ‘rates vs. price’ so you are aware of the optimum rate/price relationship?

And, as a seller, are you up for the gamble? Are you on the side of the “we’ve hit bottom” and it’s all up from here crowd or, after reading the above, do you think that now may be an opportune time to “get while the getting is good”?

We are not your typical real estate agents. We’ll help you decipher all of the ‘noise’ relating to the housing market and what decision is in YOUR best interests. You won’t get ‘objection handling techniques’, you won’t get ‘memorized dialogs’…in short, you won’t get a salesman that tries to influence and steer you in one direction or another. You’ll get honest advice tailored to your specific needs, goals and situation.

Call me directly at 561.602.1258 if you’d like to discuss anything real estate related.

And, as always, thanks for reading

12/9/12

Is housing going to get pushed over the cliff too?

There’s been non-stop chatter about the “fiscal cliff” lately. So I thought that I should discuss the housing component of the ‘fall from the cliff’.

The two major issues that will have an effect on housing: capping the amount of mortgage interest some can deduct from their taxable income, and eliminating the tax exemption on debt forgiven when a bank agrees to forgive the debt on the loss they take on a home being sold for less than the mortgage amount, either through a short sale or foreclosure sale.

Also, a tax deduction on mortgage insurance is set to expire at the end of this year. Mortgage insurance is generally required of borrowers who make down payments of less than 20%, so eliminating the insurance deduction could raise costs for millions.

One more issue, not directly related to “the cliff” but on the same timeline, is the Federal Reserves “Operation Twist”, whereby the Fed (kind of) ‘trades’ short term securities for long term ones in an effort to keep long term rates, such as mortgage rates, extremely low. If this comes to an end, especially in concert with the other fiscal cliff possibilities, it could be a disastrous combo for the tenuous housing recovery.

The National Association of Realtor (NAR) has made a clear call for help to sustain the housing market's progress in their Call for Action: Do No Harm to Housing. As stated on their website, "NAR's position is that the mortgage interest deduction is vital to the stability of the American housing market and economy and we will remain vigilant in opposing any future plan that modifies or excludes the deductibility of mortgage interest". A few days ago Speaker of the House John A. Boehner offered a potential path to compromise in year-end budget negotiation, as NAR spoke out that struggling homeowners need mortgage debt relief.

If the mortgage interest deduction is not eliminated, but scaled back to coincide with the current conforming loan limits for high-cost areas, (so rather than a million-dollar maximum limit, it might be scaled back to $625,000, for example, and interest on a mortgage higher than that figure would no longer be deductible), it may not have a major impact on the majority of housing markets.

But, the failure to renew the Mortgage Forgiveness Debt Relief Act could have a disastrous impact on short sales, and subsequently an increase in foreclosed homes, which always leads to reduced home values. Michelle J. Adams, an attorney in Rockville, Md., with a large practice assisting distressed borrowers, said that "for some homeowners the amount forgiven is a couple of hundred thousand dollars." If Congress lets the provision lapse, "the amount (owed in taxes) will be so prohibitive that many owners will walk away" - or file for bankruptcy, she said. Under the tax code, most forms of forgiven debt are treated as ordinary income – (with the temporary exception granted by Mortgage Forgiveness Debt Relief Act on principal residences) - unless the borrower is insolvent.

Concerned for the potential impact on economic recovery, Zillow pointed to the fiscal cliff in late November, saying, “The housing market has found real momentum of its own, but is not immune from shocks to the broader economy,” said Zillow Chief Economist Dr. Stan Humphries. ”If negotiations centered on resolving the fiscal cliff don’t inspire confidence in investors and consumers alike, recent home value gains – and, as a result, falling negative equity rates – could stall.”

Like I have been advising my seller clients for months…I believe that the current strong housing indicators are temporary…and if you are on the market or thinking about selling, I suggest you get it done soon!

If you’d like to discuss your situation with me, call me directly at 561.602.1258

Thanks for reading…Steve Jackson

11/22/12

11/11/12

10/23/12

Recent email I received:

"This guy at work says that Bank of America is paying homeowners to do a short sale through some new program called an HIN Incentive. I Googled HIN Incentive and couldn't really find any information on this program. Do you know what it is?

Answer: There are so many short sale programs similar to the HIN Incentive but none quite like it. It's a program initiated by Bank of America for certain preapproved short sales and works best if you don't have more than 1 loan on your home. Second lien holders often object to the cash payments.

Answer: There are so many short sale programs similar to the HIN Incentive but none quite like it. It's a program initiated by Bank of America for certain preapproved short sales and works best if you don't have more than 1 loan on your home. Second lien holders often object to the cash payments.

The HIN Incentive is an enhanced cash payment incentive, paid directly to the seller at the time of closing if certain conditions are met.

How Does the HIN Incentive Work?

Let's say you have a first mortgage with Bank of America at $300,000, and your property today has fallen in value to $180,000. The HIN incentive is based on the sales price of the property, says Bank of America. The bank does not share its calculation formula.

One such seller qualified to receive almost $6,700. The enhanced relocation assistance or the HIN incentive was almost $4,200. The seller received her check at closing. It is subject to a 1099 for the existing tax year, which means the following year she will pay taxes on that payment because it is considered income for tax purposes. Still, free is free.

How Do you Apply for the HIN Incentive?

You can call Bank of America to see if you qualify for the HIN Incentive. However, you will receive a customer service representative. I hate to say this but the odds are about 50 / 50 that a person who answers the phone will have answers to your questions.You can also ask us to open a file in Equator for you. That is the easiest and most pain-free way to begin the process. You will need to sign a third-party authorization. Once the file is opened in Equator, we will receive email confirmation. That email will be followed by another regarding borrower outreach.

BofA borrower Outreach means it is time for you to call the customer service number and discuss your foreclosure alternative options with Bank of America. One of those options is the non-government sponsored enterprise type of HAFA short sale program. Another is a GSE HAFA such as a Fannie Mae HAFA or a Freddie Mac HAFA. The qualifications for these programs vary.

Unlike the HAFA short sale, there is generally not much paperwork required for the Cooperative Short Sale program, apart from standard bank documents. By extension, there is little paperwork associated with the HIN incentive.

What Else Do You Need to Know About the HIN Incentive?

It's a fairly straight-forward process. After Bank of America qualifies the homeowner based on select investor guidelines, the bank will order a BPO (poor-mans appraisal) to establish fair market value. After market value has been established and the suggested selling/listing price has been given to us by the bank, we then list your home as a preapproved short sale. This means both you and the property qualifies for a short sale. Here are some other interesting bits of information about the HIN Incentive:- Payments vary between $5,000 and $30,000.

- Homeowners can use the money to pay liens or outstanding bills or fund a trip to Las Vegas.

- You cannot submit an offer/contract until you are preapproved for the HIN Incentive.

- The home does not need to be owner-occupied; it can be vacant

- The short sale must close by September 26, 2013.

- VA loans and FHA loans are not eligible for the HIN Incentive.

- If you do not qualify for the HIN Incentive, you might still qualify for the Cooperative Short Sale program or one of the HAFA programs.

If you think that you may be in a position to benefit from a short sale..give me a call today. All calls are strictly confidential.

My direct line is 561.602.1258…Steve Jackson

9/19/12

Palm Beach County housing showing ‘green shoots’?

It’s all over the news…The housing crisis is over! In todays Palm Beach Post is this headline: Florida home prices bottomed earlier than previously thought, according to one study…and the article goes on to state that they just realized that the bottom was in 2009!

The bottom has been reached and it’s all up from here…Green shoots are everywhere!

Not so fast…There’s a good chance those green shoots will get swamped by the coming wave of distressed home sales!

I have been following (and charting…see below) the number of Lis Pendens filed with the Palm Beach County Clerk since 2010.

Here’s another tidbit from a recent Sun Sentinel article: It takes an average of 861 days for a lender to repossess a property in Florida, says RealtyTrac Inc., a California foreclosure listing firm.

Lenders are whole heartedly resuming foreclosures following the “robosigning” scandal in which bank employees admitted using faulty paperwork and fake signatures to take back homes.

Prices have rebounded in South Florida and across the state in recent months. But those gains could easily reverse when the coming wave of foreclosures hits the market.

As we all know by now, bank-owned homes and short sales typically sell for less than a similar home would sell for if not a distressed sale, thereby hurting the values of nearby properties…and specifically creating potential for nightmare scenarios with the appraisals of non-distress-sale homes.

All the recent news stories are reporting that prices are on the upswing and have benefited from a change in the mix of homes sold with distressed properties – bank-owned homes and short sales -- accounting for only 22% of total sales, down from 31% last August.

Below is a graph of the median home price index charting back to January 2008. You’ll see, even with all of the excitement in the media the past few months, that we’re still below summer of 2009 prices. And all the the bumps in prices…they are ALL the summer buying season.

In Quarter one of 2013, when they are charting median sales prices for Oct-Nov-Dec 2012, what do you think the graph will look like?

So, to wrap up this cheery post…my take on all of the recent reports by the experts. They are wrong, period.

If there have been over 10,000 foreclosure actions started so far in 2012, and a total of over 22,000 in the past 20 months and it takes, on average, over 800 days from start to finish, it looks like we are clearly in for a very large number of distressed sales…either as short sales or bank-owned sales.

As of today, there are 11,910 properties listed for sale in Palm Beach County in our MLS system…single family/townhomes and condos. Almost exactly TWICE AS MANY properties have had a foreclosure action initiated since 1/11 than are currently for sale!

Just for fun, lets say that 50% of those in foreclosure somehow resolve the foreclosure. That still leaves over 11,000 short sales or bank-owned homes going to hit the market in the not-to-distant future…and that is just the stats if they stop filing foreclosures today! (which is not going to happen)

The short sales may hit the market sooner, unless the owners are trying to stay as long as possible. But there is no doubt that there will be new downward pressure coming.

For about 6 months now I have been counseling my customers and clients that we are in a ‘mini-bubble’ that may last a few months longer. If you have equity…now may be your best chance for a while to sell.

As always, thank for reading…Steve Jackson…561.602.1258

If you have any comments on this post, or would like to suggest a post topic…send me a text or an email.

9/17/12

If we don’t sell it…we’ll buy it!

Sounds great...especially in this market. Worth checking out? That's what the agent is hoping you'll think. Get the agents phone to ring...but they'll never discuss the details over the phone..."much to complicated and need to see your home to see if it qualifies"...get the foot in the door. But there is NEVER a free lunch; there is always a cost associated.

But, particularly in this type of market, it would be "good business" if the agent NEVER bought any homes, or if they did, that they were purchased at such a drastic discount that the could quickly ‘flip’ the home and make some money.

I have gone to several seminars where they promoted this (tactic/gimmick) and the dialog you will hear starts out something like this: " Mr./Mrs. homeowner, a big dilemma when making your move is deciding whether to buy 1st or sell 1st. Either way is risky as you could end up with 2 homes (or no home). Our unique/innovative/etc Guaranteed Sale Program solves this dilemma...you get our personal guarantee that if we don't sell your home in BLANK (30/60/90/120) days, we will buy it at a price acceptable to you. Now, WE take all the risk from you and you can immediately place a confident offer on another home". The Devil? it’s in the details:The hidden details usually follow some or all of these general guidelines:

- Must purchase one of the agents listings...or at least buy a 'full commission' home with them

- Seller must still pay a full commission on the 'guaranteed' sale

- Quite often an 'upfront' fee or guaranteed sale program fee of anywhere from $295 to fees in the thousands

- "Agreed upon" price well below appraisal/market value...could be as low as the 80% range, then subtract commissions, fees, closing costs etc.

- Original list price 5% below sale prices of comparable homes

- May be a an additional fee involved

- Seller may be required to continually lower the asking price during the guarantee period...for example: 100% for 1st 30 days, 95% day 30-60, 90% day 60-90, and so on until the “buy-out price is reached.

- Sign the listing agreement first...then the guaranteed purchase details come later

- There may be a maximum allowable program price

- Restrictions on home condition

- Use the language "I'll buy it for 'list' price", but fail to say that the 'list' price is the 80% ENDING list price

Now if they'll come right in and buy it for the price that they agree to list it for...

then that's putting their money where their dog and pony show is!

Think about these few points:- With as difficult as it is to get a mortgage now, COULD your agent actually perform on their guarantee? And what will happen if they CAN’T perform? Ask to speak with their mortgage lender...do your due diligence as with any other buyer.

- If they don't need a mortgage and have a few million sitting around to buy homes that don't sell in 90 days, why are they a real estate agent?

- Are they "flipping" the purchase option to an investor? Are they going to list the home for the investor once they buy it?

- Can they assign the guaranteed sale price (as in a wholesaler)?

Good, solid, cutting-edge marketing, a detailed understanding of the local and national economic factors affecting home values, subdivision level market knowledge, ability to analyze trends...trust and mutual respect...THIS is what is needed today. Not MORE GIMMICKS!

Thanks for reading…Steve Jackson

561.602.1258

9/11/12

9/7/12

Palm Beach County Property Tax notices are out…was your home valued too high?

This notice is not a tax bill. The Tax Collector’s Office will mail tax bills on Nov. 1. The Notice of Proposed Taxes is intended to give you an idea of what to expect when the taxing authorities work up their budgets for the 2013 fiscal year (Oct. 1, 2012-Sept. 30, 2013).

The value information shows your property’s market value for 2011 and 2012. Market value is based on the most probable sale price a willing buyer would pay in a competitive market. The 2012 tax roll is based on sales transactions that occurred in 2011.

If you believe the market value (and resulting property taxes) of your property is too high you have the right to appeal...BUT YOUR TIME IS RUNNING OUT! September 17th is the appeal deadline.

The procedure for a valuation appeal is as follows:

- You can all the PB County Property Appraisers office and speak with a deputy appraiser. The main contact # is 561-355-3230, the # listed under Residential Appraisals is 561-355-2883. If still dissatisfied, you can then appeal to the Value Adjustment Board, an independent body consisting of two County Commissioners, one School Board member and two members at large, appointed by the County Commission and School Board.

- The Value Adjust Board appeal: The VAB is set up to settle disputes between taxpayers and the Property Appraisers office. You can file your petition online HERE…but you only have until SEPTEMBER 17th…so don’t delay! Filing a petition will cost you a non-refundable $15 fee. HERE is what the actual petition form looks like.You can also file in person at the Clerk Governmental Center 1st floor office or any branch location. You can call the VAB at (561) 355-6289.

In hearings before the VAB you may represent yourself, seek assistance from a family member or a friend, or have an attorney or agent represent you.

It is recommended that you have evidence to support your petition. You can review the Florida Department of Revenue Web site for examples of evidence listed in Florida Statute 193. I am of the opinion that recent arms length transaction sales of similar properties can be the best evidence of value a homeowner can have. The county appraiser might compare your property with similar, recently sold properties to determine its market value, then multiply that by a set fraction, known as the assessment ratio. So if a property's market value is determined to be $100,000 and the assessment ratio is 80%, the assessed value for property tax purposes should be $80,000.

The next step is to check for errors in your assessment. Your local assessor's office can provide your property's record card which has information used to assess your property, such as dimensions and number of rooms; you can check that out HERE. Check that the square footage listed is correct for both the house and the land. If you find an outright error -- for example, the card says your home is 2500 sq. feet but in reality it is only 2000 sq. feet -- you may be able to show the assessor your blueprints or floor plan to get a reduction and skip the formal appeal.

Next, investigate the assessed value of similar properties in your neighborhood to see how yours compares. Look at property cards for homes of similar age and square footage with the same number of bedrooms and bathrooms. If you find that your assessed value is considerably higher than that of at least five homes (the more you can document, the better), you may have a solid case for appeal. Try to find comparable properties that are as close as possible to your own -- nearly the same square footage, in the same neighborhood, and with similar grades of construction materials.

Another option is hiring a professional real estate appraiser who will take a thorough look at your property provides the strongest evidence of its worth, but check whether your community allows outside appraisals in an appeal before you get one. If you go this route, find someone with national certification, such as through the Appraisal Institute or the National Association of Independent Fee Appraisers. Several factors contribute to the cost of an appraisal, but expect to pay about $250 to $500.

Also, if you’re friendly with a ‘competent’ real estate agent who is an expert in your area, they can provide you with a great deal of valuable information regarding the value of your home.

Lastly, there may be attorneys or other private companies that assist homeowners in challenging their tax assessment…I , however, have no experience with either and can provide no recommendations. I googled for tax assessment challenge companies and came across this one (no endorsement) And I found this book published by The National Taxpayers Union that may be of some help…(I’ve not read it and it costs $9.95)

There are specific evidence submission requirements plus you must bring all of your evidence to the hearing and be prepared to present it. When sending your evidence to the Property Appraiser, please provide two (2) copies. Do not submit evidence to the VAB clerk.

Here is a link where you can download the 2 page VAB guideline brochure.

Evidence sent before the hearing as part of the pre-hearing evidence exchange with the property appraiser should be sent to:

Property Appraiser

Governmental Center

301 North Olive Avenue

5th Floor

West Palm Beach, FL 33401

Good luck in your appeal!

Thanks for reading…Steve Jackson

561.602.1258

8/13/12

Home prices to drop another 20%?

There is a consensus forming that the U.S. housing market may finally be on the rebound. Home prices are up 4-straight months, according to the latest S&P Case-Shiller index and Zillow's U.S. home value index increased for the first time since 2007 in the second quarter.

But Gary Shilling of A. Gary Shilling is not convinced home prices have turned to the upside for good.

"The fundamental reason is there is a huge excess of inventory out there," he tells The Daily Ticker's Henry Blodget. "Some of it is listed but a lot of it is a so-called shadow inventory."

Shadow inventory refers to homes in foreclosure and waiting to be sold or properties that homeowners have delayed selling, likely to get a better price.

In his latest Insights investment note, Shilling writes "excess housing inventories, the mortal enemy of prices, measure about 2 million over and above normal working levels. That's huge considering that housing completions averaged about 1.5 million in earlier balmy years."

He also cites the backlog of delinquencies and foreclosures that were put on hold during the robo-signing investigation and settlement process.

A CoreLogic report in June showed shadow inventory fell almost 15 percent from 2011 levels to 1.5 million properties. More than half of those 2.8 million homes were "seriously delinquent, in foreclosure or REO."

"Since peaking at 2.1 million units in January 2010, the shadow inventory has fallen by 28 percent. The decline in the shadow inventory is a positive development because it removes some of the downward pressure on house prices," said CoreLogic chief economist Mark Fleming. "This is one of the reasons why some markets that were formerly identified as deeply distressed, like Arizona, California and Nevada, are now experiencing price increases."

As Shilling sees it, the banks have three options to get the bad mortgages off their books:

- Flood them onto the market

- Institute a mortgage modification plan

- Try to convert the properties into rentals

He says the second and third options are a lot less likely because mortgage modifications rarely work and rental properties are very difficult to maintain on a large scale, which may detract institutional inventors.

As a result, he believes the more likely scenario could very well end up being option number one, which would have a negative impact on home prices. The latest National Association of Realtors survey shows foreclosed properties tend to sell at a 19 percent discount to the market.

Too many foreclosures flooding the market at the same time could drive down prices of the surrounding homes.

"It would take a 22% house price drop to return to the long-run trend going back to 1890," he writes in his research note. "Since corrections of bubbles often overshoot on the downside, our forecast of a further 20% decline may be conservative."

Thanks for reading…Steve Jackson

Call me on my direct line at: 561.602.1258

8/6/12

Loan modification? Short Sale? Deed-in-lieu?

Underwater? Thinking you should pursue a loan modification?

You may know of someone who tried to modify their mortgage only to end up frustrated because your bank gave you a modification that made sense for them,NOT you. You've even probably heard where the bank actually offered someone a loan modification that actually increased their monthly payment. This typically happens because they add the missed mortgage payments to the backend of the loan, then they try and recast the loan over many more years to try and keep the payment down. But the end result is a mortgage with a higher balance on a home that's probably worth much less then what is owed.

You may know of someone who tried to modify their mortgage only to end up frustrated because your bank gave you a modification that made sense for them,NOT you. You've even probably heard where the bank actually offered someone a loan modification that actually increased their monthly payment. This typically happens because they add the missed mortgage payments to the backend of the loan, then they try and recast the loan over many more years to try and keep the payment down. But the end result is a mortgage with a higher balance on a home that's probably worth much less then what is owed.

Now, not every loan modification is done this way. In fact, certain mortgage servicers have recently come out with very aggressive loan modification programs that will reduce the principal of the mortgage balance. One of the reasons behind this is the changing of servicing rights; most mortgage holders have probably received a letter at some point telling them that their mortgage was transferred to a new company. Essentially this means that your current mortgage company sold the servicing rights to another company.

Why is the advantageous to you? Because delinquent underwater mortgages have a lesser value than performing mortgages at market value. This means that if the servicer modified your mortgage and you become a paying customer again, you just helped them increase the value of their asset (your mortgage), amazing how that works.

Start by calling your mortgage company and asking them if they have any new mortgage modification programs. And don't be fooled by a company that may want to charge you for this service. They will make the same phone call as you. It all starts with a phone call that you are perfectly capable of making.

So what are the alternatives?

Foreclosure, Deed in lieu, and Short sale.

At the end of the day it seems as if everyone would love to avoid foreclosure. And if you haven't qualified for a loan modification you're only left with a couple of choices. "Deed in Lieu" or "short sale".

Deed in Lieu is where you cooperate with the bank to essentially hand back the keys, transfer title back to the bank. Sounds easy enough but some banks may require you to attempt a short sale first...At this point, the banks don’t want any more homes in their inventory. A deed-in-lieu is basically is a foreclosure that you agree to with the bank, relieving them of the trouble and expense of going through the actual foreclosure

What is a short sale? A short sale is a property that sells for less than the balance owed on the mortgage. The lender accepts a discount on the mortgage to avoid a possible foreclosure auction or bankruptcy. The property would be purchased from a seller with the banks permission.

As you are probably aware short sales have become very common over the past few years and have played a major role in our housing recovery. The main reason is it offers many benefits to both the homeowner and the bank. Foreclosing on a home is timely and costly, so no bank prefers to foreclose, most times, they would much rather use an alternative measure like a short sale. In fact some banks are offering big short sale cash incentives to entice homeowner to list and short sale their property.

Even our Government has stepped in and created a short sale program that if you qualify, it waives any deficiency and also pays relocation assistance money to you at closing to help you get started at a new property. They have also created temporary tax policy until the end of 2012 (which we hope they extend) that again if you qualify, you will not owe any tax on the forgiven mortgage balance.

Given the great current short sale programs that are in place, If have you think that you may be a candidate for a short sale, now may be the time.

7/16/12

Palm Beach Million Dollar Short Sales!

When someone mentions short sales, the image that comes to mind is this:

But what would you think if I said “short sale” and this was the image that went along with it?

Well…right now, in Palm Beach County, there are 37 homes listed as short sales with asking prices ranging from $1,000,000 up to $13,000,000 !

There are also 6 bank owned Palm Beach homes with asking prices from $1,025,000 up to $3,500,000.

The downturn in the real estate market and the economy was not limited to just the working Joe like us…even the top tier of income earners/net worth have suffered the effects of the bottom dropping out of home values.

But, if you’re fortunate enough to still have a six-figure income or a lot of cash sitting idle…now is probably a great time to grab a seven-figure property.

- Five of them are listed as “oceanfront”

- Nine are listed as being on the intracoastal

- Four are over 5000 square feet of interior space

- Seven have private boat docks

- One is on exclusive Jupiter Island with 200’ of ocean and intracoastal!

Even if you're not in the seven-figure market, there are some great delas on the larger, upper-tier properties right now.

Give me a call on my direct line at 561.602.1258

And as always…thanks for reading…Steve Jackson

6/20/12

What do our clients think?

We can preach to you all day about how good we are, but it becomes real when you can hear it directly from a client.

This was just received by my partner, John Durante from one of his recent clients…

6/6/12

The story behind the story within the story

Recent housing data reports have been touting the “bottom” in the housing market and have been generally encouraging. However, the large number of residential properties that are "underwater"—meaning the borrower owes more on the mortgage than the property is worth—casts a long, dark shadow on the sustainability of the housing “recovery”….especially here in Palm Beach County.

Data from the most recent CoreLogic report estimates that there are somewhere in the neighborhood of 11 million homes nationwide that are under water; and, an additional 2.5 million homes have mortgages within 5% of the underwater mark. According to the most recent Zillow report, in Palm Beach County, approximately 43% of all homes with a mortgage are underwater and another 5% are within shouting distance of being underwater.

Consider this sobering as well as sad fact: out of the 4.3 million mortgages in the state of Florida, the AVERAGE equity position is 12.8%!

Now, if one were to read only the recent articles in the local papers, it would lead to the opinion that the storm has passed, the worst is over and the home price recovery is underway! Not so fast!

Consider the following: Since the 50-state Robo-signing settlement was ratified, bank have dramatically increased the rate of foreclosure filings here in Palm Beach County…March filings were up 65% over 2011, April filings were up 60% over 2011, and although May figures have not yet been released, that are expected to follow suit.

Consider the following: Since the 50-state Robo-signing settlement was ratified, bank have dramatically increased the rate of foreclosure filings here in Palm Beach County…March filings were up 65% over 2011, April filings were up 60% over 2011, and although May figures have not yet been released, that are expected to follow suit.

Florida is what is know as a Judicial foreclosure state…the aspect of that with importance to this story is the fact that foreclosures, from start to finish, average over 2 years here locally. So the foreclosure filings of March and April of this year may well not hit the market until mid 2014! Now some do move along more quickly…and some end up as short sales ( and a miniscule portion make up the missed payments or get a permanent modification). BUT, the continuing and steady flow of distressed properties into the market here will have the effect of continued downward pressure on values for the foreseeable future.

A secondary factor important to any sustained home value recovery is job creation/retention. But, the weaker-than expected jobs report for May doesn’t bode well for the overall economy, but for housing it is far more foreboding…the numbers are going in the wrong direction. The May 2012 jobs report was a step backward for housing.

“The recent trend is reminiscent of the monthly patterns of the spring slowdown witnessed over the last two years that continued through the summer months. If this pattern recurs, we expect that hopes for a meaningful housing recovery will be delayed once again,” says Fannie Mae’s chief economist Doug Duncan, who also notes that signs of improving consumer sentiment in housing is unsupported by today’s data.

If you are thinking of buying OR selling…lets talk first and I’ll give you the insight and analysis necessary for you to make the best decision.

Thanks for reading…Steve Jackson

561.602.1258 (direct)

5/28/12

5/24/12

Choose your preferred headline of the week…is the market good/bad/better/worse?

Palm Beach County homes sales surge

From the Palm Beach Post: April's single-family home sales in Palm Beach County rose a whopping 67.9 percent from a year ago, a surge that underscores the growing belief that buying a home now is a good bet.

There were 2,186 pending home sales in April, up from 1,302 during the same month last year. Townhouses and condo pending sales are up 39.2 percent, to 2,051 in April from 1,473 a year ago.

Pricing is reflecting the renewed buyer interest in home purchasing. The median sale price of a single-family homes in Palm Beach County is $210,100, up from $199,900 the same time last year and up 6.6 percent from March. The median townhouse and condo price is $88,636, up from $85,000 a year ago.

"Prices are climbing as demand increases and inventory levels decrease," said Bonnie Lazar, 2012 President for the Realtors Association of the Palm Beaches. "Inventory is slightly below normal levels, dropping over 50 percent from the previous year."

April single-family home inventory declined 55.5 percent to 5.7 months from 12.8 months a year ago. It was the same story for townhomes and condos, which fell 53.8 percent to 5.5 months from 11.9 a year ago.

Lazar said that trend should mean continued growth in home sales and median prices.

Florida still leads nation in delinquent loans, Mortgage Brokers say

Also from the Palm Beach Post: Florida still has the dubious distinction of leading the nation in “seriously delinquent” home loans, the Mortgage Brokers Association says today.Some 17.92 percent of Florida home loans were 90 days or more past due or in foreclosure during the first quarter. Nevada was a distant second with 12.63 percent of its loans seriously delinquent.

Florida carries burden of 30 percent of nation’s shadow inventory

Another recent Palm Beach Post article: The Sunshine State’s shadow inventory of 550,000 homes makes up a third of the nation’s unlisted distressed properties according to a report released this week by the Florida Realtors.

Florida Realtors chief economist John Tuccillo said despite the large volume, the slow leak of homes onto the market, as well as an increase in short sales, shouldn’t crash prices as many have feared.

The report, released Tuesday, defines shadow inventory as homes with mortgages 90 days or more delinquent, homes in the process of foreclosure and homes repossessed by the bank but not yet listed for sale.

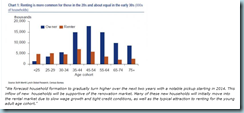

Goldman Sachs predicts that homeownership rates will decline into 2014

Goldman Sachs recently released a study looking at the housing market and attempted to analyze a bottom in regards to the homeownership rate. One of their major key figures dragging the rate lower was of course, the shadow inventory and the dismal employment outlook.

Goldman Sachs recently released a study looking at the housing market and attempted to analyze a bottom in regards to the homeownership rate. One of their major key figures dragging the rate lower was of course, the shadow inventory and the dismal employment outlook.

So…there you have it…clear as pea soup.

But if you’re reading this blog and considering buying OR selling, lets talk about what your best option is given your goals and timeframe.

Thanks for reading…Steve Jackson - 561*602*1258

5/14/12

Does It Pay To Stay?

A tough question deserves an honest answer.

And one of the toughest questions homeowners are asking us every day is, “Do I short sell my home or stay and wait until I can get out even?” Either way, to make the best decision, you should have all of the information in front of you...

That's why we created a very specific online calculator to help you ‘crunch the numbers’.

Being able to see the current market value of your home and projecting when your investment will break-even is invaluable to your decision making process. With our calculator you’ll be able to do so (for free) in a matter of minutes!

Take a look at the short video below, or go right to the calculator and find out...does it pay to stay?

Should I Short Sale My Palm Beach County Home?|

How Do I Short Sale My Lake Worth Home?

5/13/12

5/2/12

Robert Schiller of the Case-Shiller home price index says, “the world is in a late great depression”!

Yale economist Robert Shiller recently participated in a CNBC interview and gave a chilling analysis of the world economy as well as our housing market…some excerpts below:

Yale economist Robert Shiller recently participated in a CNBC interview and gave a chilling analysis of the world economy as well as our housing market…some excerpts below:

The global economy is mired in a "late Great Depression" despite central bank stimulus policies, says Yale economist and author Robert Shiller.

"Our whole economy has been affected by variations in confidence. Central banks are sort of trusted, but the actions they have often affect people’s confidence by appearance rather than substance. We’re not in the most trusting mood now,” Shiller tells CNBC.

The Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England have propped up their respective economies via liquidity injections known as quantitative easing, tools designed to spur recovery but dubbed by critics as printing money out of thin air. He says the world is in a “new age of austerity.”

Shiller, designer of the Standard & Poor’s/Case-Shiller house price index, adds it's "really hard to forecast" if the U.S. housing market is finally recovering but does find one bright spot.

"The general presumption is that home prices are going down and that's good – it'll make them more affordable."

"Reuters: NEW YORK – The United States housing market is likely to

remain weak and may take a generation or more to rebound, Yale

economics professor Robert Shiller told Reuters Insider on Tuesday.

Mr. Shiller, the co-creator of the Standard & Poor’s/Case-Shiller

home price index, said a weak labor market, high gas prices and

a general sense of unease among consumers was outweighing low

mortgage rates and would likely keep a lid on prices for the

foreseeable future.

“I worry that we might not see a really major turnaround in our

lifetimes,” Mr. Shiller said

He said suburban areas in particular might endure further price declines

as high gas prices increase demand for “walkable cities.”

Cheaper housing prices will encourage many to avoid relying on their homes as the bulk of their investment portfolio and diversify, which is a good thing, Shiller adds. "Fifty years ago, there wasn’t this talk of housing as an investment. It was a zeitgeist of the early 2000s, and it has gradually gone." The housing sector appears to be bouncing along a bottom.

It's going to be rocky for a while," says Gregory Miller, an economist at Suntrust Bank in Atlanta, according to Reuters.

Housing prices will drop by a further 20 percent as the downturn gripping the United States deepens, leading economist Gary Shilling says. Writing in the Christian Science Monitor, Shilling said more and more people are looking to rent as homeownership becomes increasingly rare. “Housing activity remains depressed, with the only life coming from the multifamily component, which is being driven by the zeal for rental apartments as homeownership falls,” he wrote.

“Homeowners are losing their abodes to foreclosures; many can’t meet stringent mortgage lending standards; some worry about homeownership responsibilities in the face of job uncertainty; and many people have no desire to buy an asset that continues to fall in price.

“I am looking for a further 20 percent slide in housing prices.”

As my dedicated blog readers know, you don’t come here for sugar-coated real estate stories. I always try to dig deeper into what is being reported…piece together related analysis…give you a clear and “no spin” picture of our real estate environment.

Feel free to call me directly at 561.602.1258

Thanks for reading…Steve Jackson

4/21/12

Who is buying all of these homes? And what does it mean?

I just finished going over NAR’s 2012 Investment and Vacation Home Buyers Survey,which covered existing- and new-home transactions in 2011. The report showed that investment-home sales surged an extraordinary 64.5 percent to 1.23 million last year from 749,000 in 2010. Vacation-home sales rose 7.0 percent to 502,000 in 2011 from 469,000 in 2010. Owner-occupied purchases fell 15.5 percent to 2.78 million.

A recent CNBC article (excerpted below) notes the risk of what the NAR report exposed:

While nearly half of investment buyers said they were likely to purchase another property within two years, housing and mortgage analyst Mark Hanson calls them a “thin cohort” and worries that they add ever more volatility to the current housing recovery.

“They are fickle and volatile. They will go away on the slightest of conditions changes. They also won’t chase prices higher or buy new homes from builders. Lastly, without the heavy flow of distressed supply, there is no U.S. housing market recovery. Distressed sales ARE the market,” says Hanson.

Remember…investment is all about the numbers. Change anything where the numbers aren’t as attractive — even something as minor as HOA fees — and investor demand dries up. To an investor, a house is not a home: it’s cashflow + equity. These investors analyze a house in exactly the same way they would analyze a bond or a stock.

Even if house prices remain stable, if rent rates drop, that changes the investment equation. Now the investor isn’t interested even if the price remains at $200K, because his cashflow projections are all out of whack.

Any hint of rent regulation, and an investor would have to be a fool, politically connected, or pay such a low price that he’ll still make money under rent control, to even consider buying rental properties.

Stan Humphries, from Zillow recently said, “some markets have likely seen their bottom (think Washington DC or Phoenix, both of which we forecast to see appreciation in 2012),but nationally, the bottom in home values is some way off. Your cautions all fall in line with exactly what we at Zillow have been observing – high percentages of cash buyers, investors flocking to the market to take advantage of rising rental rates (with rents up 3% nationally during 2011). We’re forecasting the national bottom in home values for 2013, and we expect that most large markets will continue to see depreciation throughout 2012. We introduced a formal forecast in our Q1 reports. (You can see the Zillow report here: http://bit.ly/yRwRj7.

As I always tell my clients…”take every news report you read/see/hear with a grain of salt”. Most agencies who put out the stories have an agenda to promote…and most reporters no longer look into the details of any story they are given.

The recent great housing news…(i.e. sales/prices up), is being driven by a very narrowly motivated segment of buyer: “investors”. If there is any small shift in the tax laws benefiting income properties, rental rates; any reduction of cash-on-cash return or after tax return…you can bet the investors will be back on the sidelines.

Call me directly and lets talk about how all of this (and more) affect/influences your real estate selling or buying goals.

Thanks for reading…Steve Jackson

561.602.1258

4/19/12

Todays real estate headlines in the news…Pick your flavor

- Epic supply backlog

- A secular shift from plunging demand via habitation patterns, as more and more simply opt to live with their parents

- More and more are forced to rent

- Home prices will slide ever more as the American Dream of home ownership is forgotten, leading to even less wealth extraction via home equity loans

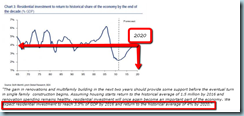

- Which all means there is no hope for a long, long time…not at least until 2020

1) It's safe to sell your home again:

The Realtors' group's chief economist, Lawrence Yun, opted to look on the bright side of the report -- sales were up 5.2% year-over-year. "We have seen nine consecutive months of year-over-year sales increases," he said. "Existing-home sales are moving up and down in a fairly narrow range that is well above the level of activity during the first half of last year."

2) Housing recovery still sputters:

NEW YORK (CNNMoney) -- The housing market continued to struggle in March, despite low home prices and record low interest rates, an industry report revealed Thursday.

Sales of existing homes fell 2.6% compared with a month earlier, to an annualized rate of 4.48 million homes, the National Association of Realtors said. Gus Faucher, a senior economist at PNC Financial, called the report disappointing. "We were expecting an increase," he said. "We need a turnaround to help the economy recover.

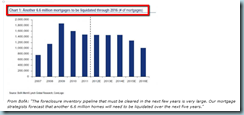

3) No Housing Recovery Until 2020 In 5 Simple Charts

Every day (for the past 3 years) we hear countless fairy tales why housing has bottomed and will improve any minute now. Just consider the latest kneeslapper from that endlessly amusing Larry Yun of the NAR, uttered just today: "pent-up demand could burst forth from the improving economy." Uh, right. Here's the truth - it won't and here is why, in 5 charts (below) directly from Bank of America, so simple even an economist will get it.

The so called “recovery” is about to get impaled by a tsunami of foreclosures with prices dropping a further 5-10% - recovery will take years with the added bonus that those who have been living rent free are about to direct some of that windfall of "disposable income" to actually paying for shelter…watch how that effects the overall economy!

As always…thanks for reading!

Steve Jackson

561.602.1258

4/7/12

Home Affordable Foreclosure Alternatives (HAFA) for Palm Beach County Residents extended through 2013

The Making Home Affordable (MHA) Program was introduced by the Obama Administration in 2009 in an attempt to stabilize the housing market and help struggling homeowners obtain relief and avoid Foreclosure. The program consisted of several smaller programs including the Home Affordable Modification Program (HAMP), the Home Affordable Refinance Program (HARP and the new HARP 2.0) and the Home Affordable Foreclosure Alternatives Program (HAFA).

The Making Home Affordable (MHA) Program was introduced by the Obama Administration in 2009 in an attempt to stabilize the housing market and help struggling homeowners obtain relief and avoid Foreclosure. The program consisted of several smaller programs including the Home Affordable Modification Program (HAMP), the Home Affordable Refinance Program (HARP and the new HARP 2.0) and the Home Affordable Foreclosure Alternatives Program (HAFA).

HAFA is a government-sponsored initiative assisting all Home Affordable Modification Program (HAMP) eligible homeowners in avoiding foreclosure through a short sale or deed-in-lieu of foreclosure.

The program recently announced updates and changes that will take effect June 1st.

These changes will allow a greater number of distressed homeowners to seek assistance.

The major changes from March's updates to the HAFA program include:

- Extending the deadline for submitting for HAFA eligibility will be extended a full year, from December 31, 2012, to December 31, 2013.

- The removal of occupancy requirements. Previously, HAFA required homeowners to have lived in the property within the last 12 months.

- $3,000 relocation incentives will be limited to properties occupied by an owner or tenant at the time of the short sale.

- Mortgage payments will be allowed to exceed 31% of the homeowner's gross monthly income. This update will allow a homeowner to stay current on their mortgage and still qualify, minimizing the overall impact to their credit.

- Secondary lienholders may receive up to a maximum of $8,500, up from $6,000 previously.

- And one of the most dramatic changes: The Credit Bureau Reporting will be Account Status Code 13 (paid or closed account/zero balance) or 65 (account paid in full/a foreclosure was started), as applicable.

With these updates, a homeowner can be current on their mortgage, qualify for HAFA, continue to make their payments, and execute a short sale with minimum impact on their credit!

If you are upside down on your home…call me today. My direct line is 561.602.1258

Thanks For Reading…Steve Jackson

3/22/12

3/7/12

Fourth Quarter and Year-End 2011 U.S. Foreclosure Sales Report: Shifting Toward Short Sales

RealtyTrac® (www.realtytrac.com), the leading online marketplace for foreclosure properties, today released its Q4 and Year-End 2011 U.S. Foreclosure Sales Report™, which shows that sales of homes that were in some stage of foreclosure or bank owned accounted for 24 percent of all U.S. residential sales during the fourth quarter — up from 20 percent of all sales in the previous quarter, but down from 26 percent of all sales in the fourth quarter of 2010.

“We continued to see a shift toward pre-foreclosure sales, or short sales, and away from REO sales in the fourth quarter,” Moore continued. “Nationally, pre-foreclosure sales increased 15 percent from a year ago while REO sales decreased 12 percent. Pre-foreclosure sales outnumbered REO sales in several bellwether markets, including Los Angeles, Miami and Phoenix, where REO sales had outnumbered pre-foreclosure sales a year ago. That trend will likely show up in more local markets in 2012 as lenders recognize short sales as a better option for many of their non-performing loans.”

If you are upside-down..don’t wait..call me today, please. This year may be your best opportunity to sell your home in a manageable and dignified way.

My direct line is 561-602-1258.

Thanks for reading, Steve Jackson

2/12/12

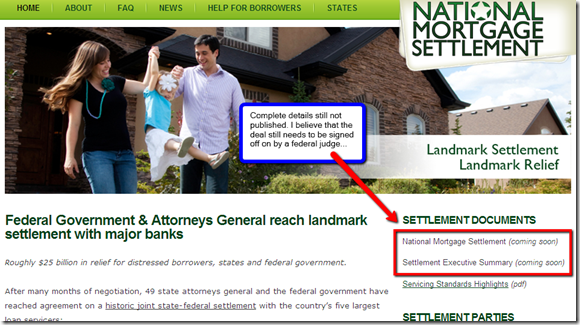

Foreclosure Fraud Settlement Update…

Full and complete details are still not available as of today. We have been given only the main points of the agreement. Missing still are the most important aspects; the implementation and enforcement details. As the well known saying goes…’The devil is in the details’ (see below).

A previously ‘settled’ suit by Nevada/Arizona against Bank of America for failing to follow their responsibilities in the Countrywide settlement will be folded into the deal. In that settlement, BofA promised to deliver $8.5 billion in relief for Countrywide borrowers who fell victim to deceptive practices in the mortgage process. In reality, only $236 million was ever spent. Weak settlement terms allowed BofA to take credit merely for offering loan modifications to borrowers. And the Nevada suit alleged that BofA immediately started abusing borrowers who tried to get relief under the deal. But that suit is now gone.

State and federal regulators insist that they learned their lesson with that botched settlement and that this one has tight enforcement guidelines. (Sure!) However, the monitoring process begins with a self-assessment from the banks through quarterly reports, which will then be reviewed by a govt. determined committee. This enforcement process is likely to take months to ‘properly assess’ the settlement.

What has been made public is that 5 billion will go as a hard cash penalty to the states, which can use the monies, for what appears to be, any reason. As a matter of fact, one official close to the talks stated that he feared that much of that cash payout will go in some states toward filling their budget holes. The federal government will get a cash penalty as well (how much? for what purposes?) Out of that $5 billion, up to 750,000 borrowers wrongfully foreclosed upon will get (up to) a $2,000 check if they sign up for it and it is determined that they qualify (who can qualify and what the process is has yet to be disclosed). For someone wrongfully foreclosed on, foreclosed on with fraudulent documents or denied due process, this is the equivalent of saying to them “sorry we broke the law and stole your home, here’s one months rent, now go away quietly.”

The bulk of the money, NOT actually a payment of any kind, around $17 billion, will go towards loan modifications, principal write-downs, short sales and other foreclosure avoidance efforts.

This figure pales in comparison to the negative equity in the country, which sits at, at least, $700 billion. Nationally, 1 in 5 mortgages is currently under water…here in Florida, almost 1 in 2 mortgages is under water. AND the banks have 3 years to implement these processes and procedures.

It will be many years into the future, after this ‘landmark settlement’ has faded from scrutiny, before it can be determined if the promises on loan modifications, etc., have been fulfilled.

Do you think this multi-billion-dollar settlement is tough on the banks?Lets look at the stock prices of the banks involved in this settlement…did they fall through the floor as a result of the drastic penalties invoked?

- Well, just before Christmas, Bank of America stock dipped below the $5.00 mark; on Friday, it closed over $8.00…UP OVER 60% in 60 days! Nice…and one would have to have their head firmly in the sand to think that the terms of this settlement were not widely distributed to the ‘in’ crowd in the past 60 days.

- Citi..again, from a low point of about $25 the same day, just before Christmas, to a close of about $33 on Friday…a 30% return in 60 days…not as good as BofA, but still not bad for the insiders.

**and the mention of insiders brings up this point: Our elected officials do not have to comply with the rules/laws governing the trading of equities on inside information. I’d like to see how many of the ‘peoples representatives’ (privy to the details/impact of this settlement) bought bank stock in the past 60-90 days.

- JPMorgan Chase…Same date of the low…just before Christmas at just under $31, to a close on Friday of just under $38.00…only a 22% return (and that's NOT annualized) on that trade.

- Wells Fargo…SAME low date just before Christmas, of about $25.50 to a close on Friday of $30.30. Another tidy return of about 20% in 60 days.

If you laid these charts on top of one another…they are almost identical in movement! The terms were leaked, the impact evaluated, and then the party started!

I’ll post again on this when the FULL details are finally released, whenever that may be!

Thanks for reading and putting up with my heavy dose of cynicism…Steve Jackson

Call or email me any time with your take on the matter, 561-602-1258

2/9/12

The BIG bank settlement…

Here are the main details of todays multi-state bank fraudclosure settlement…my analysis and opinion will come in a few days, after I have had time to read and digest the full settlement (which I have to diligently search for because it is not readily available)

NEW YORK (CNNMoney) -- The nation's five largest banks have finally struck a deal with 49 states to settle charges of abusive and negligent foreclosure practices dating back to 2008.

Under a deal announced Thursday, the banks will commit $26 billion to help underwater homeowners and compensate those who lost their homes due to improper foreclosure practices…

What did the mortgage lenders and loan servicers agree to do? The banks and servicers have committed at least $17 billion to reduce principal for borrowers who 1) owe far more than their homes are worth 2) are behind on payments.

The amount of principal reduction will average about $20,000 per borrower.

Another $3 billion will go toward refinancing mortgages for borrowers who are current on their payments. This will enable them to take advantage of the historic low interest rates currently available.

The banks will pay $5 billion directly to the states, the only hard money involved in the deal. Out of that fund will come payments of $1,500 to $2,000 to homeowners who lost their homes to foreclosure. Other funds will be paid to legal aid and homeowner advocacy organizations to help individuals facing foreclosure or experiencing servicer abuses.

Another $1 billion will be paid directly by Bank of America to the Federal Housing Administration to settle charges that its subsidiary, Countrywide Financial, defrauded the housing agency.

In addition, the banks agreed to eliminate robo-signing altogether and to use proper and legal procedures when putting homeowners through the foreclosure process. They also agreed to end servicer abuses, like harassing delinquent borrowers for payments, and to include principal reductions more often in their mortgage modifications programs.

Is my mortgage lender taking part in this settlement? Bank of America, Wells Fargo , JPMorgan Chase, Citigroup and Ally Financial

are taking part in the settlement.

In addition, nine other unnamed loan servicers may join the settlement later, and that would bring its value to $30 billion.

Loans owned or backed by Fannie Mae and Freddie Mac, however, are not part of the deal. The Federal Housing Finance Agency, which oversees the two government-sponsored mortgage giants, will not allow any balance reductions for loans insured by the companies under the settlement.

I lost my home to foreclosure; how do I know if I qualify for payment? If you were foreclosed on in the calendar years 2008 through 2011, you may be be eligible for a payment of up to $2,000. People who think they may qualify should notify their bank.

What should I do if I think I may qualify for a principal reduction or refinanced mortgage? Contact your lender/servicer and ask them to review your case.

If I take the money, what rights do I give up? Individual borrowers do not give up any right to sue.

As part of this deal, state attorneys general gave up the right to sue the mortgage servicers for foreclosure abuses arising out of the robo-signing scandal. However, they reserve the right to sue if they uncover improper acts when the loans were originated or when they were securitized.

When will the new rules and bank policies be put into place? Most of them have already become part of bank policies.

When will homeowners get paid? HUD said the settlement will be put before a court for approval within two weeks. It is unknown how long it will then take for a court to rule.

The relief for homeowners has to be completed within three years, but the state attorneys general and HUD want it to be front-loaded and completed within 12 months.

Would I have to pay taxes on the principal reductions or the pay-outs? If the principal is reduced in 2012, it will not be subject to income tax.

That's because the Mortgage Debt Relief Act of 2007 allows taxpayers to exclude income from the discharge of debt on their principal residence. The act is scheduled to expire at the end of this year, however.

So if the act is not extended and the principal reduction occurs in 2013, borrowers may be on the hook to pay taxes on the settlement amount.

It's not clear whether you would have to pay taxes on the $1,500 to $2,000 payout. The IRS declined to comment on the question.

Will the settlement make it harder to get a mortgage? The new rules and regulations the banks have agreed to under the settlement should have little impact on future mortgage borrowing since most of practices are already in place, said Keith Gumbinger of HSH Associates, a mortgage information provider.

Only $5 billion of the $26 billion settlement will be a direct cost to the banks. The remainder will be the cost of modifying mortgages. Many of those modifications may be in the best interests of the banks to make, however, since the alternative may be foreclosure, which can cost banks more than modifications.

Come back in a day for my insight and analysis of the States Attorneys General settlement with these 5 banks! I’m certain it will be a bit different than the popular spin being put on it now.

Thanks for reading…Steve Jackson

561 602 1258 (direct)

1/25/12

––For Every Two Homes Available for Sale, There Is One “In The Shadows”––

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders. Transition rates of “delinquency to foreclosure” and “foreclosure to REO” are used to identify the currently distressed non-listed properties most likely to become REO properties. Properties that are not yet delinquent but may become delinquent in the future are not included in the estimate of the current shadow inventory. Shadow inventory is typically not included in the official metrics of unsold inventory.

Data Highlights:

- As of October 2011, shadow inventory remained at 1.6 million units, or 5-months’ supply and represented half of the 3 million properties currently seriously delinquent, in foreclosure or in REO.

- Of the 1.6 million properties currently in the shadow inventory (Figures 1 and 2), 770,000 units are seriously delinquent (2.5-months’ supply), 430,000 are in some stage of foreclosure (1.4-months’ supply) and 370,000 are already in REO (1.2-months’ supply).

- Florida, California and Illinois account for more than a third of the shadow inventory. The top six states, which would also include New York, Texas and New Jersey, account for half of the shadow inventory.

- The shadow inventory is approximately four times higher than its low point (380,000 properties) at the peak of the housing bubble in mid-2006. A healthy housing market should have less than one-month’s supply of shadow inventory, which would be an easily absorbed stock of distressed assets with little or no discernable impact on house prices, unless the inventory was geographically concentrated.

- Despite 3 million distressed sales since January 2009, a period when home prices were declining at their fastest rate, the shadow inventory in October 2011 is at the same level as January 2009.

- Because shadow inventory is often concentrated in suburban and exurban submarkets, where distressed sales compete with new construction sales, it is one of the reasons why new home sales continue to be weak. In normal times, new home sales account for 12 percent of all sales, but they are currently running at 7 percent of all sales.

- Based on current estimates of the visible inventory (both distressed and non-distressed), the shadow inventory is approximately half of all visible inventory listings. For every two homes available for sale, there is one home in the “shadows”

“The shadow inventory overhang is a large impediment to the improvement in the housing market because it puts downward pressure on home prices, which hurts home sales and building activity while encouraging strategic defaults,” said Mark Fleming, chief economist for CoreLogic.

The full report can be found at http://www.corelogic.com/ShadowInventoryOct2011.

I do follow CoreLogic reporting every month…however, there are other, credible, estimated of the shadow inventory of 3-4 times what CoreLogic reports. And this is what is going to keep our values from increasing any time soon.

Thanks for reading…Steve Jackson

Call me directly at 561-602-1258

1/20/12

1/6/12

Freddie Mac offers help for the unemployed

Freddie Mac, (Bulletin 2010-17), is introducing new forbearance requirements to provide a “short-term unemployment forbearance” relief option to assist Borrowers who are unable to make their Mortgage payment due to unemployment.

In addition, Freddie Mac is introducing an “extended unemployment forbearance” relief option to provide an extension of the forbearance period if such Borrowers have not regained employment after the short-term forbearance period has ended. Including these additional relief options in our loss mitigation tool kit gives unemployed Borrowers an opportunity to retain homeownership by providing Mortgage payment relief while they seek re-employment.

Servicers will have delegated authority to approve eligible Borrowers for a short-term unemployment forbearance period of six months during which time the monthly Mortgage payment is either suspended or reduced.

If the Borrower remains unemployed at the end of the short-term unemployment forbearance period, the Servicer must consider the Borrower for extended unemployment forbearance in accordance with the Guide.

If the Borrower meets the eligibility criteria for extended unemployment forbearance, the Servicer must obtain Freddie Mac’s written approval before entering into an extended unemployment forbearance plan with the Borrower.

EFFECTIVE DATE: Changes announced in this Bulletin are effective February 1, 2012 for all new Borrower evaluations for an alternative to foreclosure. However, Servicers may begin implementing the unemployment forbearance relief options earlier for all new requests for assistance in which an eligible Borrower’s hardship is unemployment.

If you have any question about Freddie Macs new plan, above, or any other questions regarding foreclosure alternatives, please pick up the phone and call me directly at 561-602-1258...or send me an email

Thanks for reading my blog…Steve Jackson

Smith Farm, Lake Worth Florida...Foreclosure tracker

As of 4/1/10 the are 94 Smith Farm homes in some stage of foreclosure.