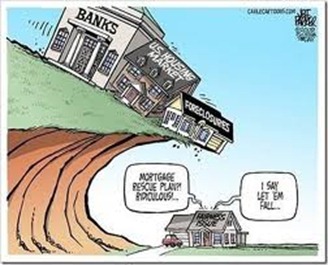

There’s been non-stop chatter about the “fiscal cliff” lately. So I thought that I should discuss the housing component of the ‘fall from the cliff’.

The two major issues that will have an effect on housing: capping the amount of mortgage interest some can deduct from their taxable income, and eliminating the tax exemption on debt forgiven when a bank agrees to forgive the debt on the loss they take on a home being sold for less than the mortgage amount, either through a short sale or foreclosure sale.

Also, a tax deduction on mortgage insurance is set to expire at the end of this year. Mortgage insurance is generally required of borrowers who make down payments of less than 20%, so eliminating the insurance deduction could raise costs for millions.

One more issue, not directly related to “the cliff” but on the same timeline, is the Federal Reserves “Operation Twist”, whereby the Fed (kind of) ‘trades’ short term securities for long term ones in an effort to keep long term rates, such as mortgage rates, extremely low. If this comes to an end, especially in concert with the other fiscal cliff possibilities, it could be a disastrous combo for the tenuous housing recovery.

The National Association of Realtor (NAR) has made a clear call for help to sustain the housing market's progress in their Call for Action: Do No Harm to Housing. As stated on their website, "NAR's position is that the mortgage interest deduction is vital to the stability of the American housing market and economy and we will remain vigilant in opposing any future plan that modifies or excludes the deductibility of mortgage interest". A few days ago Speaker of the House John A. Boehner offered a potential path to compromise in year-end budget negotiation, as NAR spoke out that struggling homeowners need mortgage debt relief.

If the mortgage interest deduction is not eliminated, but scaled back to coincide with the current conforming loan limits for high-cost areas, (so rather than a million-dollar maximum limit, it might be scaled back to $625,000, for example, and interest on a mortgage higher than that figure would no longer be deductible), it may not have a major impact on the majority of housing markets.

But, the failure to renew the Mortgage Forgiveness Debt Relief Act could have a disastrous impact on short sales, and subsequently an increase in foreclosed homes, which always leads to reduced home values. Michelle J. Adams, an attorney in Rockville, Md., with a large practice assisting distressed borrowers, said that "for some homeowners the amount forgiven is a couple of hundred thousand dollars." If Congress lets the provision lapse, "the amount (owed in taxes) will be so prohibitive that many owners will walk away" - or file for bankruptcy, she said. Under the tax code, most forms of forgiven debt are treated as ordinary income – (with the temporary exception granted by Mortgage Forgiveness Debt Relief Act on principal residences) - unless the borrower is insolvent.

Concerned for the potential impact on economic recovery, Zillow pointed to the fiscal cliff in late November, saying, “The housing market has found real momentum of its own, but is not immune from shocks to the broader economy,” said Zillow Chief Economist Dr. Stan Humphries. ”If negotiations centered on resolving the fiscal cliff don’t inspire confidence in investors and consumers alike, recent home value gains – and, as a result, falling negative equity rates – could stall.”

Like I have been advising my seller clients for months…I believe that the current strong housing indicators are temporary…and if you are on the market or thinking about selling, I suggest you get it done soon!

If you’d like to discuss your situation with me, call me directly at 561.602.1258

Thanks for reading…Steve Jackson

No comments:

Post a Comment