Back in early to mid 2011 the market value of homes here bottomed out. Then several big hedge funds started scooping up everything under $300k…with ‘all cash’ offers. Home prices/values had been on quite a tear since…until recently.

What happens from here is difficult to predict. With the elections having just tilted back towards the Republicans we should quickly see if this translates into a more robust economy/jobs/business environment.

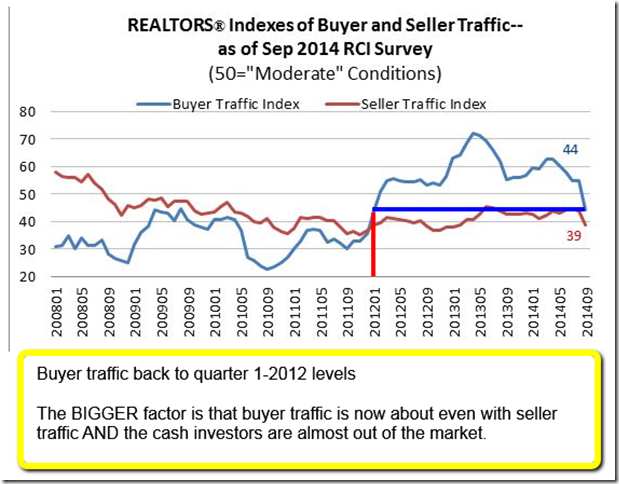

The current market may look like a ‘standoff’ between sellers and buyers.

But is not about standoffs, it’s about negative feedback loops and positive feedback loops:

Positive feedback loop: buy because prices are increasing, don’t put your house on sale because next year you can get 15 percent more. All of a sudden you have low inventory and rising prices, further feeding the loop.

Negative feedback loop: prices are stalling, let’s wait to see where they are in a year. Let’s sell that house now before prices fall further.

Let’s not forget, there is a lot of investor housing bought in the last 36 months that may quickly make it back on the market once the price gains stall out.

I’ll keep an eye on this…you keep an eye on this blog.

Thanks for reading…Steve Jackson…561.602.1258

No comments:

Post a Comment